Upgrading customer experience for payment solutions with Woosmap

The Covid-19 pandemic has accelerated the shift towards business digitisation, particularly within the financial services sector. Today, 80% of people choose to manage their money online rather than use their local bank branch (Digital Banking Attitudes Study by Chase Bank). When it comes to digitisation, it is boom or bust. There is a lot at stake here, not only for traditional banks, but also for new players in the world of digital finance; from neobanks, invoicing and budget management tools, and online insurance services, to store and brand-related debit or credit cards, and other fintech platforms.

In a world where billions of people make transactions online every day, payment data has never been more extensive or accurate. Location-based technologies play a key role in ensuring these transactions remain secure, enhancing user interfaces, and improving data reliability for better analysis.

According to a study conducted by J.P. Morgan, 95% of business leaders believe that location-based data has a significant impact on business results. Moreover, 91% of them are convinced that this impact will only magnify over the next three to five years, suggesting that geolocation is fundamental for future business development, particularly within the payments industry.

Unleashing the potential of location-based data

Updated in the European Union’s Payment Services Directive (PSD2) encourages innovation, competition, and transparency. Free access to banking data under General Data Protection Regulation (GDPR) stimulated the emergence of many intermediaries in the world of digital payments.

The era of Open Banking has seen consumers generate more payment data than ever before. Payments today can even be linked with a specific place, such as a particular shopping centre, shop, hotel, or restaurant: and the more accurate the data, the greater its value.

Woosmap Geofencing SDK allows marketers to trigger personalised campaigns based on user's location

According to Mediametrie, 82% of customers are willing to share their geolocation in exchange for consumer benefits like lower pricing on products and services.

Game on! The question is how will fintech, banks and neobanks tackle this data to improve their marketing ROI and retain customers in an industry that became lately so volatile?

From our standpoint, it’s by offering a bionic approach - combining the best of human and digital, and location comes in handy for doing this!

By redesigning user experience through location, bankers will be able to reach out to their customers at the right time, in the right place, and with the right service or information to assist them. Here are some examples.

Powering your app with geolocation for better user experience

Automating geolocation in the mobile app user journey, allows customers to focus on the real value and purpose of the app. As a result, this creates a seamless and frictionless user experience and leaves the attention span for discovering the core banking features and products. According to a BCG, users of financial services, particularly of online banks — spend between 8% and 17% more time on applications that offer a personalised geolocated experience.

How to fight bank fraud with geolocation?

Another research reveals that financial service firms are up to 300 times more likely to experience a cyber attack per year compared to companies in other industries. Therefore the European Payments Council recommends in2021 Payment Threats and Fraud Trends Report to engage in working with other players to develop standardised digital identification methods for safer e-com purchases and online access to bank account information.

Validating user Identity

Thanks to geolocation capabilities, financial services can verify a user’s identity using a simple, fast and effective form of double authentication. For example, a credit card company may ask a new user registering on their platform to share their geo-location, to ensure their location matches the address provided.

Flagging unusual buyer behaviour

By spotting unusual buyer behaviour (for example, transactions made in two different cities or countries in short succession), it is possible to flag potentially fraudulent transactions. Geolocation can also be used to map ATM withdrawals or unsuccessful payments in order to detect potential anomalies.

However, in this digital age, many people often make transactions online, making it more common for customers to make payments in multiple countries within a short time frame. To accommodate this reality, payment companies utilise a risk scale according to selected parameters to identify suspicious behaviour and avoid as many false positives as possible. BCG reports that financial players were able to reduce the number of fraudulent transactions by 30% using geolocated data.

With the rise of Web3, blockchains and non-fungible tokens (NFTs, digital tokens that can be thought of as certificates of ownership for virtual or physical assets), transaction security is becoming a major concern for everyone within the field of finance. In this dynamic and increasingly competitive market, geolocation helps neobanks, traditional banks and other players in the sector gain a reputation as trusted intermediaries.

How to bring more clarity to payment data with geolocation?

Take a typical payment statement for a bank card. The user is faced with a hard-to-decipher list of transactions that is full of acronyms, and often with no tangible information provided for each payment. Frustrated, they may turn to customer service, incurring additional costs for the company.

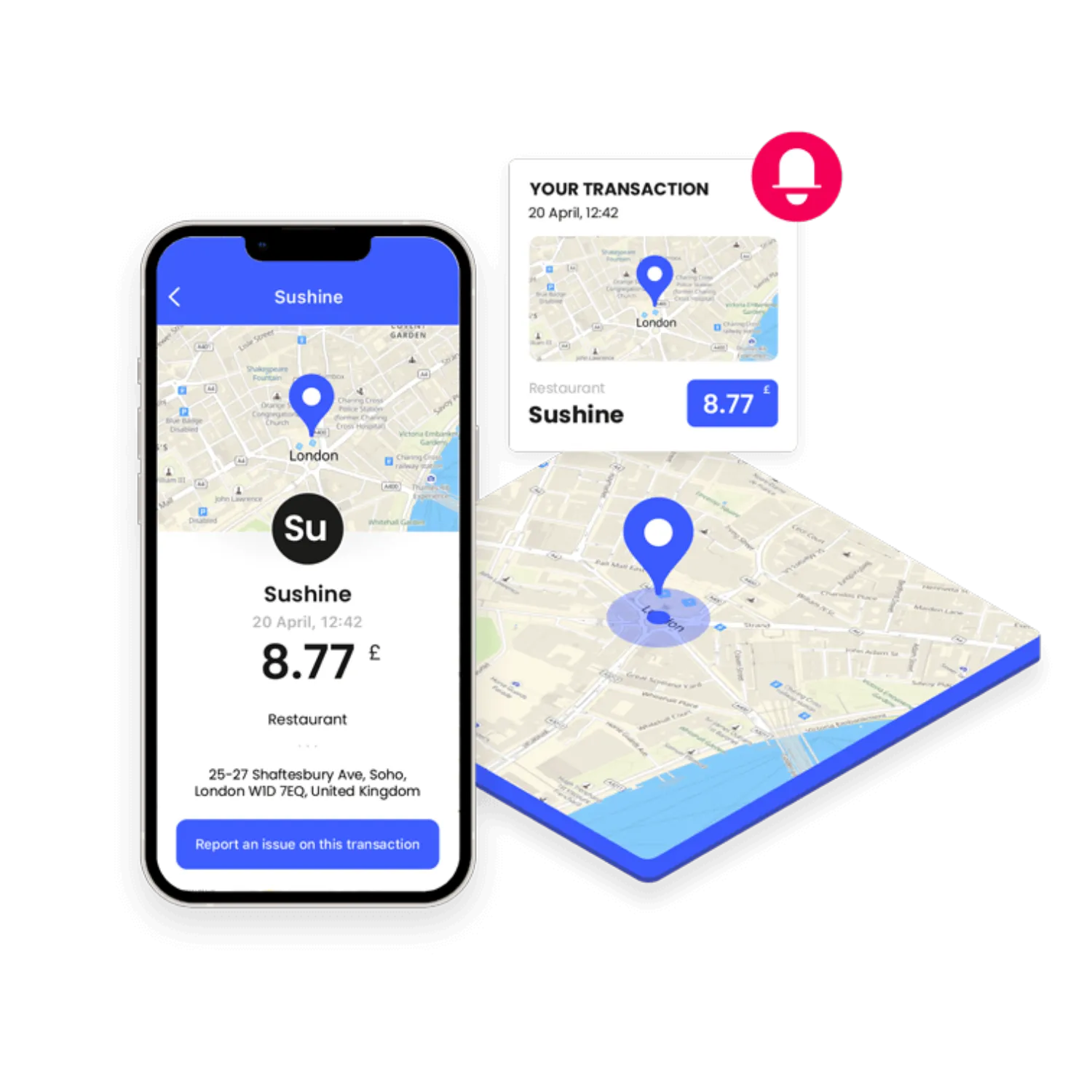

In the modern world, for the new generation of customers, this is a deal-breaker, if they can switch for another service with better UX, they will do it in a heartbeat! This is where geolocation comes in, offering innovative solutions to this problem. Woosmap has developed the Merchant API solution to improve transaction clarity. It associates as many transactions as possible to the name of the brand and its logo, and it also detects identifiers to determine the geographical location of the transaction wherever possible. This solution allows payment companies to provide their customers with easy-to-recognize statements — something that will appeal to every user who values bank accounts with more transparency.

Woosmap Merchant API cleans up bank transactions, making them much more readable

If a user has any questions or concerns regarding a payment, they can use the business records on Google Business Profile to contact the establishment from which they made their purchase directly. Our clients that implemented this solution have reduced the number of customer service calls related to unrecognised transactions by 50%.

In the same fashion, we recorded another positive feedback from a bank dedicated to children’s financials. Parents' users, preoccupied with their children's safety and protection, find it simple to follow up on their kids' expenses and their location. With a simple glance at their banking statements, they can monitor their activity and can easily step in if there is any suspicious transaction.

Boosting marketing in Payment Services with Location

How to meet the customer where they are?

Obsess over being there for their customers in micro-moments and they are right. What better timing for suggesting a loan than while visiting a DIY shop, checking on a partner real estate agency, or a car dealership? Build location-based scenarios with personalised loan offers and be ready when the customer needs you the most. According to our clients, these offers are 3 times more likely to convert than the regular advertising.

With tools such as Woosmap Geofencing SDK, the bank's app needs just to define this type of scenario given the user's geolocation position and trigger the notification in the back office.

How to anticipate customers' needs?

It goes without saying that millennials and the next generation of customers have fewer ties to their banking services than their parents. Remaining relevant to them over the long term requires the next level of personalisation and engagement.

By pairing mobile location data and spending history, businesses can develop customer profiles and segmentations around shopping behaviours and can definitely deliver the unexpected!

Collaborating with merchants to develop intelligent affiliate cashback programmes that will offer customers targeted discounts based on places they visit and their buying history, helps position your bank/institution as a proactive player. Taking the lead over your customer spending, negotiating better prices for them, and consequently educating your customer for managing better their finances drives customer loyalty.

Cornerstone Advisors notes that only about one-third of financial institutions use mobile-related data at all. Banks have always sat on the invaluable purchase data their clients generate but haven't extracted value from it. The time is now to create a new stream of revenue!

How to upgrade offline banking experience in a post-covid era?

During the pandemic, the neobanks and other fintechs substantially raised the bar for digital services. This is making the comeback of traditional banks very difficult. So now, if a client decides to go personally to a bank, they expect a stellar customer experience. A survey performed by PWC shows that it’s crucial for the millennials to feel important when they go to a bank and every interaction between the finance company and them should aim at better relationships.

Here’s how geolocation can help:

- Provide an interactive route to the nearest branch or ATM thanks to a Store Locator Widget. For a seamless search experience, create various filters for differentiating your branches and also provide directions through various transportation means in real-time. See samples of examples of our clients: Virgin Money, Yorkshire Bank, and Clydesdale Bank.

- Offer a warm welcome.

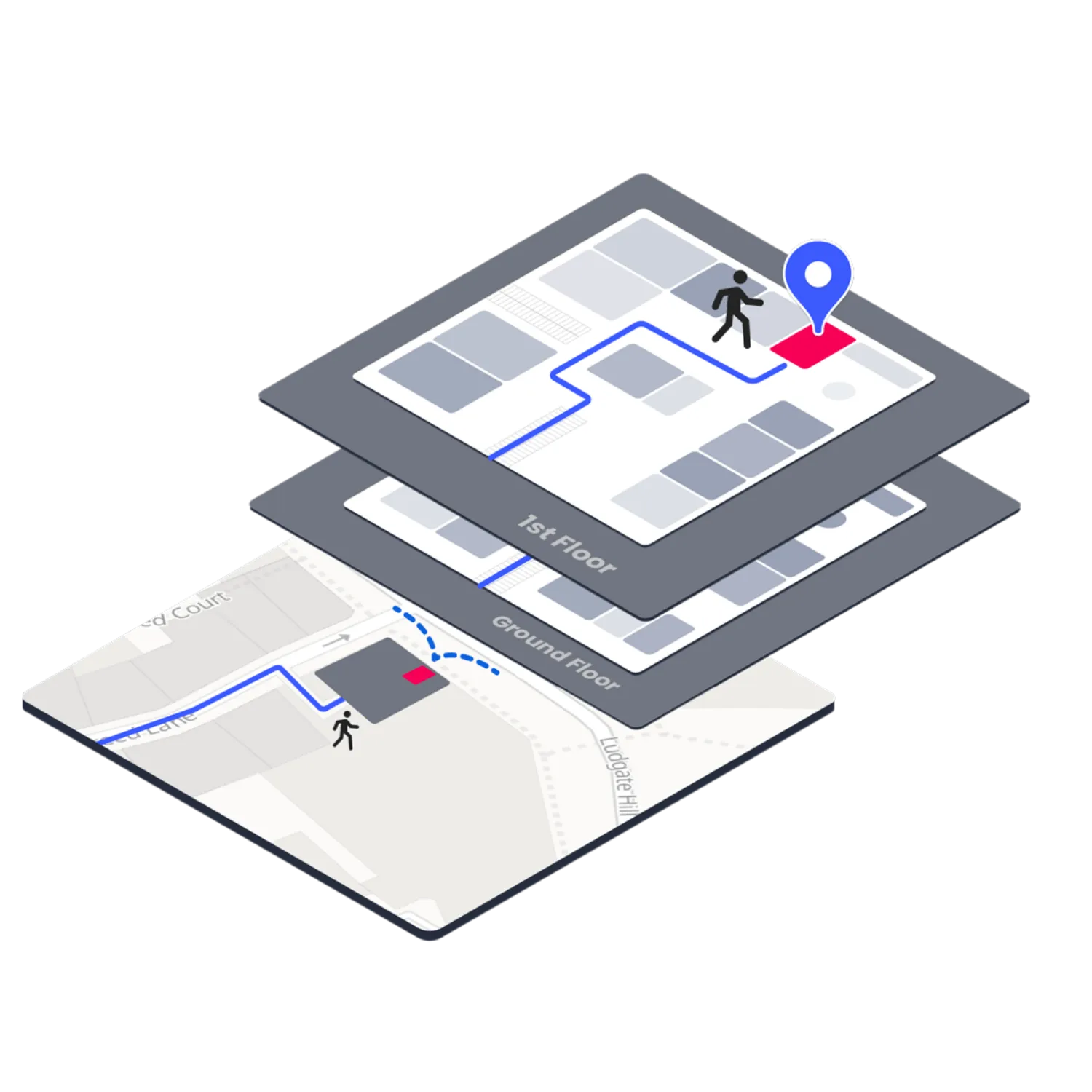

- Use Woosmap Geofencing SDK for the various use case scenarios to trigger events: cardless entry into ATM lobbies, assigning a queue number automatically or alerting the staff when a VIP client is about to enter a branch. For improved guidance in the building, rely on Woosmap Indoor for someone that needs accessibility support. Barclays implemented a service called “Barclays Access” which notified staff when a customer with accessibility needed to enter the branch.

- The meeting is over? Trigger automatically a satisfaction survey right after the customer hits the door! Gather feedback at the perfect time.

Conclusion

Geolocation offers a very competitive ground for fintechs and banks to attract and engage customers in a world that has lately become more and more digitally savvy. At its core, the purpose of geolocation is to analyse user behaviour for offering personalised user experiences but it also represents a solid tool to fight fraud. Top neo-banks and other modern payment services have already recognised the importance of enhancing their business models with location-based services.

The opportunity has never been riper for the picking, and now banks hold all the cards. Careful communication campaigns based on location data and easy-to-use applications with intuitive interfaces pay-off by customer loyalty!